The cash conversion cycle is the number of days it takes a company to turn it’s production efforts into cash.

In business terms, it’s a metric you need to track that indicates how long it will take you to get your money back (and be profitable) on an investment in any advertising, marketing and sales efforts and personnel that work to produce sales and run your business.

If you want to invest in our business successfully, it’s crucial that you know what the cash conversion cycle is on every investment you make so that you 1) get the most out of your budget and 2) get the best return on your investment in everything you do.

Failure to comprehend how this benchmark works in your business can cost you a lot of money and limit your business’ ability to make money, even to the point where it could put you out of business - for good.

To help you make heads or tails of things, here’s a review of how the cash conversion cycle impacts various aspects of your business and what you should take into consideration before laying out your hard-earned cash and putting it to use on something or someone.

Cash Conversion Cycle: How to Invest in Your Business

Cash conversion cycles vary in length based upon what you’re looking to accomplish through your investment.

In most cases, shorter is better, but longer works if the outcome is worth it.

No matter the time frame, it’s crucial that you know what’s at stake when you put your hard-earned commissions to work.

Here’s how the cash conversion cycle affects certain parts of your business.

Lead generation

With most real estate transactions, you know that you’re roughly 45 days away (maybe longer) from closing on a listing sale from the day you put it under agreement.

If you take a closer look here, you’ll notice that it can take as many as 15 to 30 more days from the time you set the appointment, take the listing, stage the home, do the pre-inspection, take photos and put it on the MLS.

If you take an even closer look, you’ll see that only 3% of the leads you generate are now business that will close in 90 days or so. 20% are as many as 90 days out and 60% are as far away as a year from selling or buying a home.

Knowing this, it’s vital that you make good decisions where you’re going to spend your money depending upon how long it takes to get it back because in many cases...it could take a longer than you might be willing to wait.

Take these timelines into consideration when figuring out where to spend your commission dollars on lead generation:

- Direct mail: 1 to 3% response rate and you need about 6 months to a year of consistent effort before you start to get any leads. ROI can be good, but it could take up to a year to get money back on your investment. Before you go and wallpaper a subdivision with flyers, postcards and newsletters, it’s important that you know this.

- Circle prospecting: The cash outlay here is fairly inexpensive and you can get a large number of leads for what you pay. You should be able to pull at least one to two potential seller leads out of each call session. Nurtured leads convert at about 8%, which is good. The cash conversion cycle could be a year, here, too, but the investment is way less.

- Home value leads: Like circle prospecting, home value leads are more economical. Also, like circle prospecting leads, they could be as long as a year out. The majority of the ones that do sell are going to do so within 6 to 8 months. Roughly 9% of them convert to a sale within a year, so the conversion is decent here, too.

- Expireds/Withdrawns/FSBOs: The great news here is that if you’re going to get some now business, it’s likely to come from this source. The tough news here is that these lead sources get hammered daily by other agents in your marketplace, so you may have to call them more than once to get a foot in the door. These leads are fairly inexpensive and give you a good shot a talking to some motivated sellers. The should be staple in every agent’s lead generation arsenal.

- Past clients and sphere: These leads are the least expensive of them all. The real challenge is that there’s no real indication that they’re going to sell, which requires you to invest consistent time and energy to be in front of these folks so you’re there when they are ready to pull the trigger. Your investment in strengthening these relationships will be rewarded, it just may take some time.

Details like this are key for you to know when it comes to the cash conversion cycle of these and any other lead generation sources you invest in.

Investing thousands of dollars on direct mail to secure one or two sales in a six-month period could very well cripple your business.

It’s important that you invest your money wisely and in such a way that you get the best return on your investment (ROI) in the shortest amount of time to keep your bank account flush and your business humming along.

The more money you have coming in and in your bank account, the more flexibility you have to send it out and wait longer to get it back.

No doubt, all of these lead generation strategies will have a place in your business at one point or another...it’s simply a matter of employing them at the proper time based upon your core capital and your ability to keep your business running smoothly between your initial investment and see your money come back.

Brand Recognition

Every businesses needs brand recognition in their marketplace.

All things being equal, there’s a huge difference between advertising your brand and generating leads with which you can do business.

So many agents invest thousands on billboards, wrapped vehicles, print advertising and other methods of branding in dire hope of bringing in solid, consistent leads.

At the end of the day, branding does more to let people know what you do and less to get them to contact you to want to do business.

Now, does this mean that these and other branding strategies don’t have a place in your business? No. It simply means that the cash conversion cycle is long (and very tough to wait out) on branding strategies, especially when you don’t have good cash reserves.

Also, it’s hard to pinpoint which deals may come directly from your branding efforts, so getting your hands around the cash conversion cycle can be tough.

Now, can someone seeing you on a billboard help you get a listing? Certainly.

Also, would your wrapped vehicle driving around town help you build authority with seller prospects? Absolutely

All true.

Despite that, branding can be - and often times is - very expensive and in many cases won’t specifically net you lots of sales from your investment.

And again, results can be hard to track.

A good rule of thumb here is that you should have at least $500 to $1,000 a month that you don’t need to run your business before you should invest in branding strategies.

Bringing on personnel

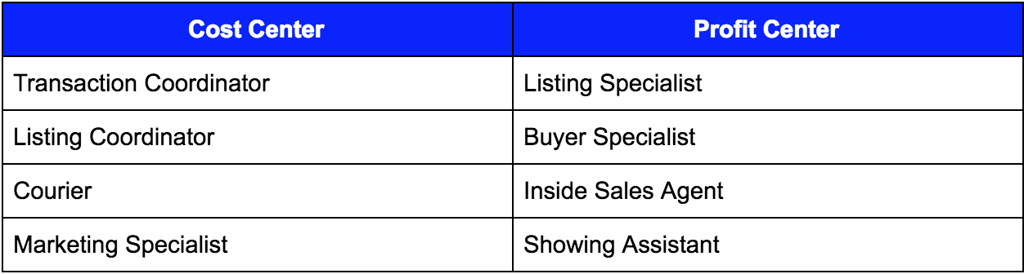

Every business also has cost centers and profit centers.

Any part of your business that doesn’t specifically bring in revenue is a cost center.

Conversely, any part of your business that brings in revenue is a profit center.

It makes sense that the cash conversion cycle on jobs held in profit centers is historically shorter than it is with those on jobs held in cost centers because the former bring revenue in the door.

Armed with this information, you must be sure you can pay for at least 3 to 4 months salary for a hire on the cost center side of your business before you pull the trigger. You’ll likely want to do the same with hiring an Inside Sales Agent ( ISA ) just to be sure.

Handling the hire in this way ensures that you can pay that employee’s hourly rate/annual salary for one normal sales cycle of selling some homes until money comes in to cover them.

The only one-off here could be your first hire, which should be an administrative assistant.

I say this because hiring an administrative assistant when you start to get super busy frees you up to do more deals and make more money.

When it comes to the cash conversion cycle as it applies to your first admin hire, the time frame is shorter because of what it allows you to do in growing your business.

Other than that, you must invest your money wisely when hiring someone so you don’t burn through money that you may not get back for a while.

In no uncertain times, the cash conversion cycle is about fiscal responsibility.

You must know at a very deep level how long it’s going to take to get your money back before you make an investment.

It’s the only way to ensure that you have the money to spend and can be without the use of it until you get it back.

In addition to that, you must make sure you have enough money in your bank account to sustain your business and sales efforts before you spend one penny on strategies to grow your business.

Having a deep understanding of the cash conversion cycle can make a big difference in you spend and save money and in how you grow your business.

Pay heed to what I’ve shared here and you’ll soon become a cash conversion cycle expert.

Let Us Know What You Thought about this Post.

Put your Comment Below.